Strategic Collaborations for Durability: Bagley Risk Management

Strategic Collaborations for Durability: Bagley Risk Management

Blog Article

Just How Livestock Risk Security (LRP) Insurance Policy Can Safeguard Your Animals Investment

In the realm of livestock investments, mitigating dangers is vital to making sure economic stability and development. Livestock Threat Protection (LRP) insurance policy stands as a trusted shield against the uncertain nature of the market, offering a tactical technique to guarding your assets. By diving into the ins and outs of LRP insurance policy and its complex benefits, livestock producers can fortify their investments with a layer of safety that goes beyond market variations. As we check out the realm of LRP insurance coverage, its function in securing animals financial investments becomes significantly noticeable, guaranteeing a course towards lasting financial resilience in an unpredictable sector.

Understanding Livestock Threat Protection (LRP) Insurance Policy

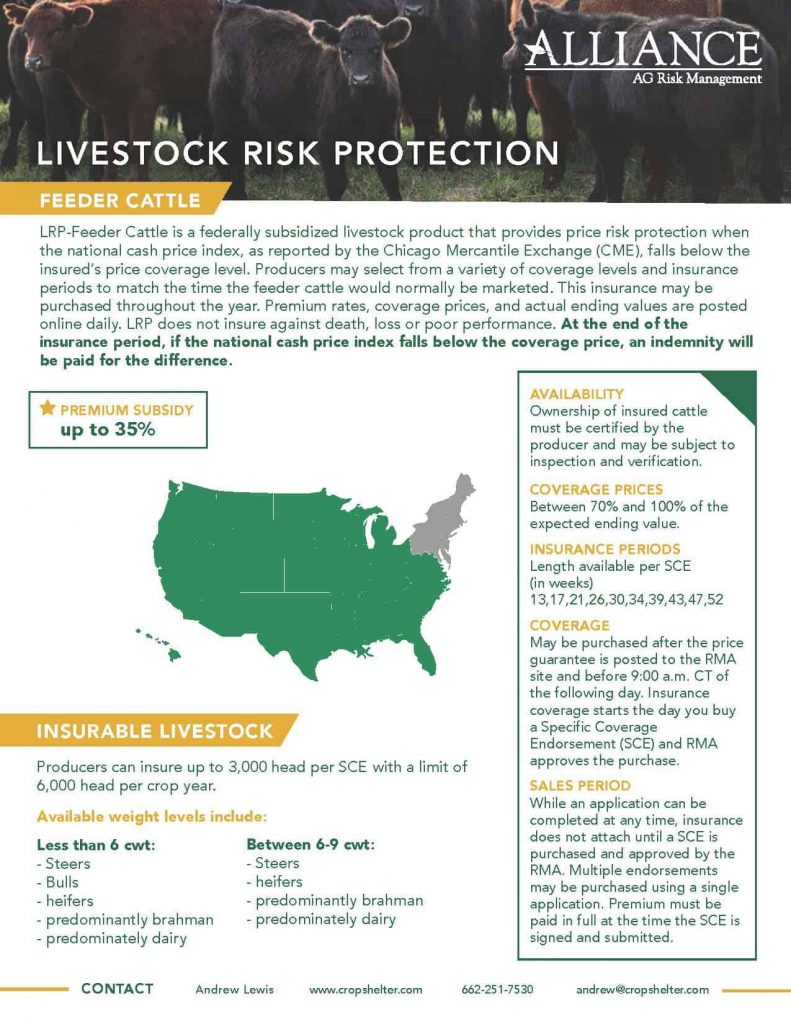

Comprehending Animals Danger Protection (LRP) Insurance coverage is vital for livestock producers looking to reduce economic threats linked with cost variations. LRP is a federally subsidized insurance coverage item developed to protect manufacturers against a drop in market costs. By offering protection for market price declines, LRP aids manufacturers lock in a floor cost for their livestock, guaranteeing a minimal level of profits despite market changes.

One key aspect of LRP is its versatility, enabling manufacturers to personalize protection levels and policy lengths to suit their particular demands. Producers can choose the variety of head, weight variety, insurance coverage rate, and protection period that align with their production goals and risk tolerance. Comprehending these adjustable choices is essential for producers to efficiently handle their rate threat exposure.

In Addition, LRP is readily available for different livestock types, consisting of cattle, swine, and lamb, making it a functional threat management tool for livestock producers throughout various sectors. Bagley Risk Management. By familiarizing themselves with the ins and outs of LRP, producers can make educated choices to protect their financial investments and guarantee monetary stability when faced with market unpredictabilities

Benefits of LRP Insurance Policy for Animals Producers

Animals producers leveraging Livestock Risk Protection (LRP) Insurance policy obtain a tactical benefit in securing their financial investments from rate volatility and protecting a stable monetary footing among market unpredictabilities. One vital advantage of LRP Insurance is cost protection. By setting a floor on the cost of their animals, producers can alleviate the threat of significant financial losses in the event of market declines. This permits them to prepare their budgets a lot more efficiently and make informed choices regarding their procedures without the continuous concern of cost changes.

Furthermore, LRP Insurance policy provides producers with peace of mind. Overall, the advantages of LRP Insurance policy for animals manufacturers are considerable, using a useful tool for taking care of danger and ensuring monetary protection in an unforeseeable market atmosphere.

Exactly How LRP Insurance Coverage Mitigates Market Risks

Reducing market threats, Livestock Threat Protection (LRP) Insurance gives livestock manufacturers with a dependable guard versus cost volatility and financial uncertainties. By offering security against unanticipated rate decreases, LRP Insurance aids producers secure their investments and keep economic security in the face of market changes. This sort of insurance enables animals manufacturers to lock in a cost for their pets at the beginning of the plan duration, ensuring a minimal cost level no matter of market adjustments.

Steps to Safeguard Your Livestock Investment With LRP

In the realm of farming danger management, implementing Animals Danger Security (LRP) Insurance entails a calculated process to protect investments versus market variations and uncertainties. To safeguard your animals investment successfully with LRP, the very first action is to evaluate the certain risks your procedure encounters, such as rate volatility or unanticipated weather condition occasions. Next, it is vital to study and choose a credible insurance provider that provides LRP plans tailored to your animals and business requirements.

Long-Term Financial Safety And Security With LRP Insurance

Guaranteeing sustaining monetary security through the usage of Animals Risk Defense (LRP) Insurance is a sensible long-term approach for agricultural manufacturers. By incorporating LRP Insurance policy into their threat administration plans, farmers can protect their animals financial investments against unforeseen market changes and adverse events that can endanger their monetary wellness in time.

One trick Our site advantage of LRP Insurance for long-lasting monetary protection is the tranquility of mind it uses. With a dependable insurance plan in place, farmers can minimize the economic dangers connected with unpredictable market conditions and unforeseen great post to read losses due to factors such as condition episodes or all-natural catastrophes - Bagley Risk Management. This stability enables manufacturers to concentrate on the daily operations of their livestock business without consistent stress over possible financial troubles

Additionally, LRP Insurance coverage gives a structured approach to managing threat over the long-term. By establishing specific insurance coverage levels and choosing ideal endorsement durations, farmers can customize their insurance coverage intends to align with their monetary goals and take the chance of tolerance, making certain a sustainable and safe future for their livestock operations. Finally, buying LRP Insurance coverage is an aggressive strategy for agricultural manufacturers to accomplish long lasting economic security and safeguard their source of incomes.

Conclusion

In conclusion, Livestock Danger Security (LRP) Insurance policy is a beneficial device for livestock producers to reduce market risks and secure their investments. It is a smart option for guarding animals financial investments.

Report this page